Baidu , once China’s top search engine, is surging ahead as a key AI chip maker, challenging Huawei to replace Nvidia amid U.S. export bans. Its Kunlunxin subsidiary drives this shift with high-performance chips for AI training and cloud tasks. Analysts see explosive growth ahead in domestic demand.

Baidu unveiled a bold five-year Kunlun AI chip roadmap this month, launching the M100 in 2026 for efficient inference in large models. The M300 follows in 2027 for massive multimodal training. These integrate with Baidu’s ERNIE AI, reducing foreign chip reliance while blending current Nvidia tech.

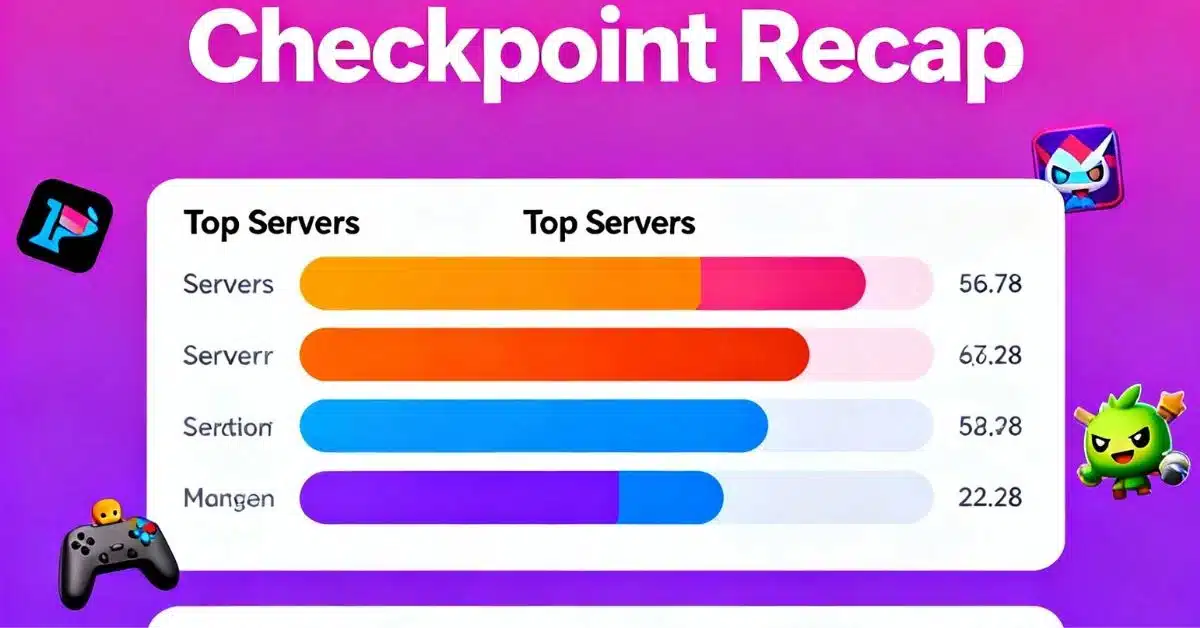

Kunlunxin secured over $139 million in orders from China Mobile suppliers earlier this year, proving market traction. Chips match Nvidia’s CUDA platform, easing adoption for telecom and enterprise workloads. This win underscores Baidu’s edge in filling AI hardware voids.

Deutsche Bank praises Kunlunxin as a top domestic developer for LLM training, inference, cloud, and telecom needs. Baidu sells chips to data center builders and rents cloud power, building a full-stack AI ecosystem with servers and models. Momentum builds steadily.

U.S. curbs block Nvidia’s elite GPUs from China, while Beijing discourages even compliant H20 chips. Regulators recently barred ByteDance from Nvidia purchases, pushing firms toward locals like Baidu. This policy accelerates self-sufficiency in semiconductors.

Huawei leads with huge chip clusters but faces supply limits from sanctions. Baidu steps in as the next powerhouse, with JPMorgan forecasting six-fold chip sales to 8 billion yuan ($1.1 billion) by 2026. Hyperscalers favor homegrown solutions now.

Macquarie values Kunlunxin at $28 billion, signaling investor faith in Baidu’s strategy. The unit spun off in 2021 with Baidu holding majority stake, now serving banks, grids, autos like Geely, and more. Real-world deployments expand rapidly.

Alibaba and Tencent report AI chip shortages bottlenecking data centers. Alibaba’s CEO flags supply as a two-year hurdle; Tencent cuts capex due to availability, not weak demand. Crisis boosts Baidu’s role.

Baidu’s Tianchi supernodes link hundreds of chips for superior AI performance, with Tianchi512 coming in 2026. These rival Western clusters, prioritizing system efficiency over single-chip speed amid lithography limits. China’s chip self-sufficiency hit 13.6% last year.

State rules mandate domestic chips in funded data centers, sealing off foreign rivals. Baidu’s P800 chips already handle most internal inference, training trillion-parameter models in massive clusters. This positions it centrally in national AI goals.

Despite layoffs after Q3 losses, Baidu invests heavily in chips for long-term dominance. Kunlunxin’s CUDA compatibility and order wins make it ideal for China’s intense AI compute needs. The Nvidia gap fuels a new era of local innovation.