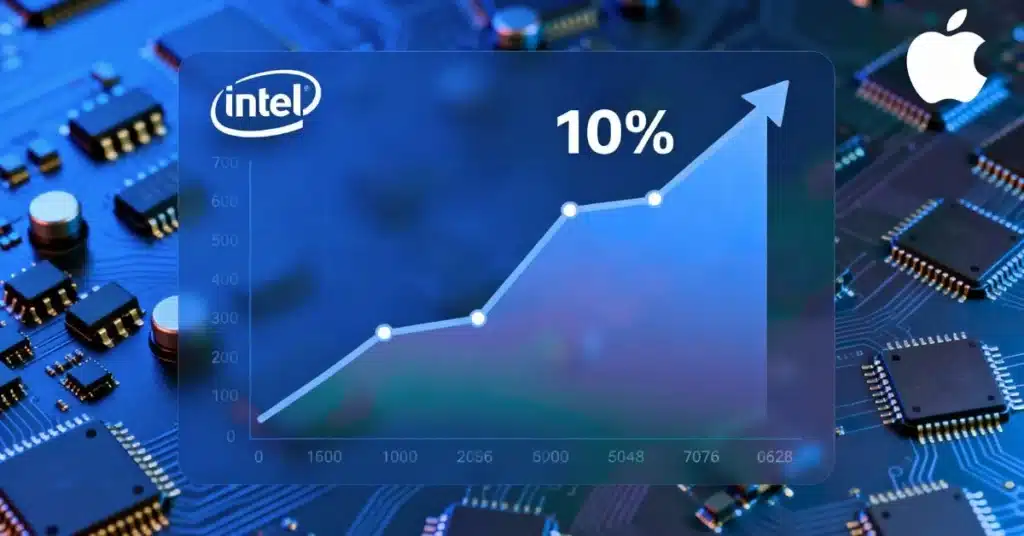

Intel stock surged 10% recently, fueled by growing speculation that Apple may restart using Intel chips in 2027. This potential partnership, suggested by notable industry analyst Ming-Chi Kuo, is seen as a major catalyst for Intel’s stock rally and a hopeful sign for the chipmaker’s revival in the competitive semiconductor market.

Intel has been pushing aggressively to regain its footing as a key semiconductor supplier after years of losing ground to rivals like AMD and Apple’s transition to its own custom ARM-based M-series chips. The news that Apple might return to Intel for certain chips is sparking optimism among investors that Intel’s manufacturing prowess and innovations could once again secure a sizable contract from the tech giant.

The 10% price rise in Intel’s shares reflects widespread investor enthusiasm over the rumored deal. Market watchers note that Apple’s vast scale can provide a substantial boost to Intel’s revenue and chip production volume. However, experts also caution that while the rumors are promising, a formal agreement is yet to be announced, and the deal, if it comes, may be contingent on Intel meeting critical technology and supply benchmarks.

Intel’s stock had been struggling to maintain upward momentum given the competitive pressure from other chipmakers and the ongoing challenges in the semiconductor supply chain. The news of a possible partnership with Apple is currently the foremost positive development for Intel, pushing its shares higher and drawing renewed attention from the investment community.

As the tech world watches closely, the big question remains if Apple will truly make Intel a key chip supplier again starting 2027 or if the talks will fall through. For now, Intel’s investors are riding a wave of optimism awaiting further confirmation from both companies.